नेपाली सन्देश डट कम | ३० चैत्र २०८१, शनिबार ०७:४४

नेपाली सन्देश डट कम | ३० चैत्र २०८१, शनिबार ०७:४४

Pratiksha Pandit:

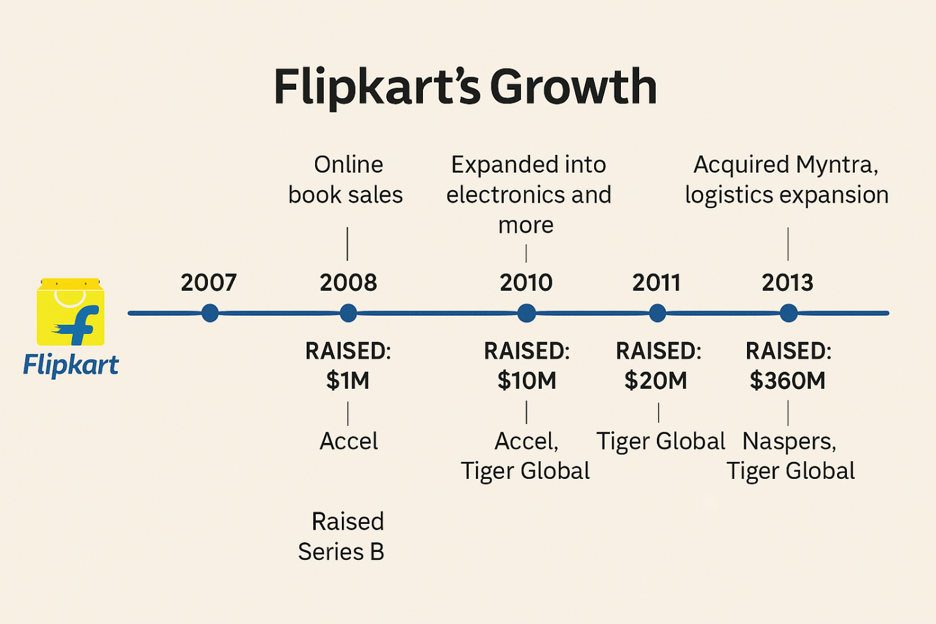

As a company has achieved product market fit and now scaling in operation, fund needs of company increases and Venture Capitalist could be one of your go to options amongst many. Let’s see the story of Flipkart and how they leveraged the Venture Capitalist for their success.

Flipkart Success Story paints a clear picture of advent of new age for Indian startups, fueled by entrepreneurship spirit, in 2007 A.D the company was founded as online seller of books. By adopting new idea, innovation and right strategies and in year 2018, 77% of the company share was acquired for $16 Billion by USA based multinational retail chain Walmart, which is said as one of the biggest strategic investment in the history in this market segment. Flipkart gained a game changer and highly successful- status in Indian business landscape, as with this acquisition from Walmart, India has been proven as most attractive and profitable market in the globe in retail ecommerce business.

As per Forbes, Formal Amazon Executive Sachin Bansal partnered with Binny Bansal in establishing this ecommerce giant company with minimum investment of USD 6000, operating from their apartments. Thanks to various round of funding made by different Venture Capitalist (VCs), they backed the company well raising various rounds of funds helping company to expand in market and their operation, win over competition resulting huge leap within a period of decade only from 2007-2018 A.D.

Source: Internet

Flipkart growth stage started around 2008-9 with VCs Investment to 2015 which is pre profitable and competition era for company. Flipkart, strategically leveraged VCs funds over traditional financial modality such as banks. VCs gives risk fund not monthly interest and installment – debt against land mortgage as. VC financed Flipkart got a strategic opportunity to spend on creating their business and ecommerce industry, keep customers as their first priority and build a trusted brand, gave discounts and burned cash in exchange of higher future value of company, expanded their product segment, supply and distribution chain and logistics, built a tech infrastructure, gained mentorship and support to create a good business in not yet profitable industry. Otherwise, if opted for traditional models of investment, it would be harder to pull all of these growth status because they need to look for immediate profits for interest and installment against debt rather than building a brand.

Base key indicator for business reached the growth stage is characterized when company has established a proven business model in market with your product has reached to customer and the demands for product and services are accelerating, it has maintained a predictable revenue streams with good customer base as now is the time to be established as market player in the face of competition.

Ready to optimize your growth strategy? Contact us at shekharbastakoti362@gmail.com, Pratiksha199619@gmail.com . We welcome your insights and collaboration opportunities.

प्रतिक्रिया